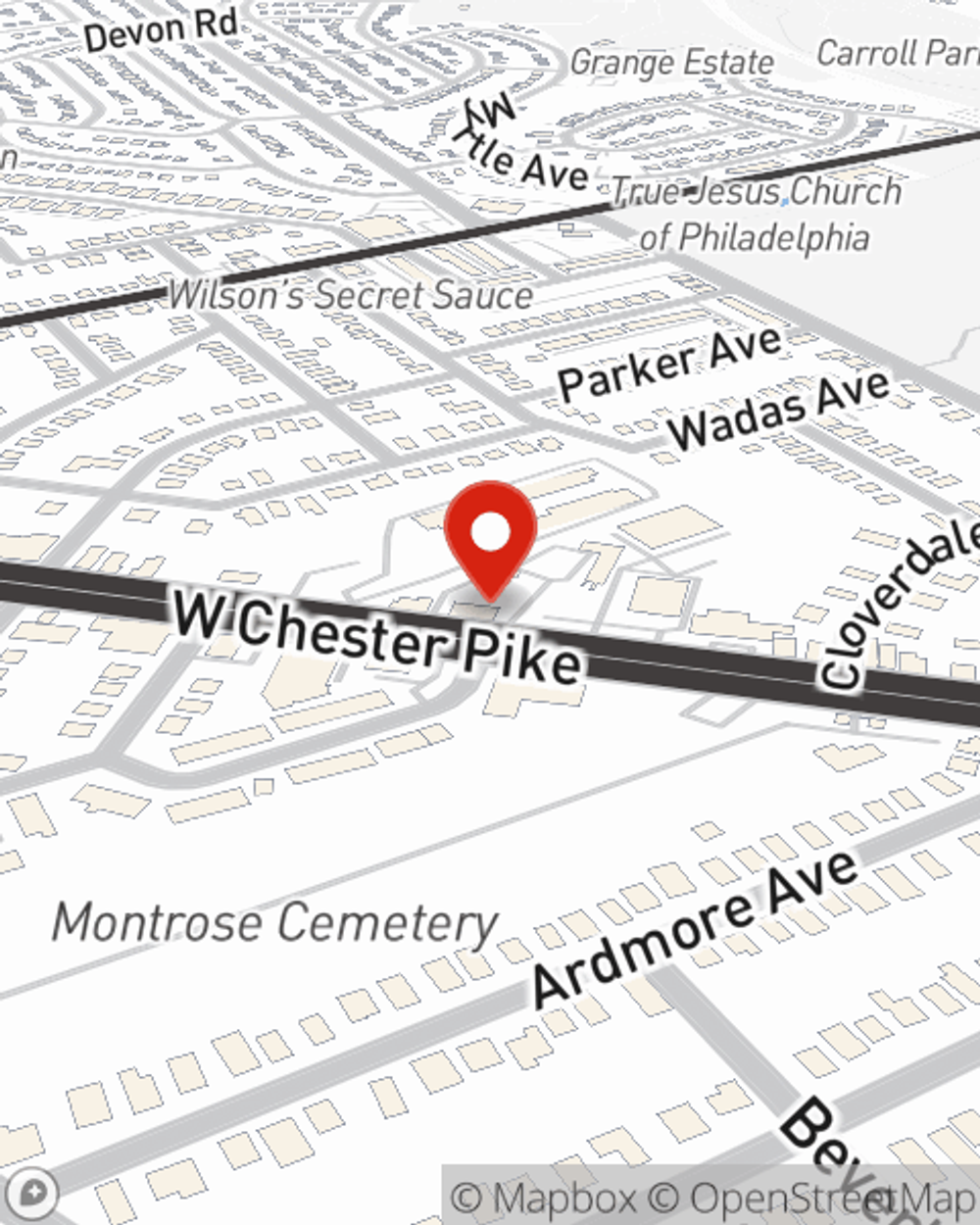

Business Insurance in and around Upper Darby

One of Upper Darby’s top choices for small business insurance.

Insure your business, intentionally

- UPPER DARBY, PA

- NEW JERSEY

- DELAWARE

- PENNSYLVANIA

- DELCO

- CHESCO

- MONTCO

- SOUTH JERSEY

- PHILADELPHIA

- KING OF PRUSSIA

- DREXEL HILL

- SPRINGFIELD

- Lansdowne

- DARBY

- Merchantville

- Havertown

- DELANCO

- GLOUCESTER CITY

- CAMDEN

- MORTON

- LANCASTER

- BALA CYNWYD

- BRYN MAWR

- LANSDALE

Insure The Business You've Built.

Running a small business comes with a unique set of wins and losses. You shouldn't have to deal with those alone. Aside from just those who care for you, let State Farm be part of your line of support through insurance options including extra liability coverage, a surety or fidelity bond and errors and omissions liability, among others.

One of Upper Darby’s top choices for small business insurance.

Insure your business, intentionally

Small Business Insurance You Can Count On

Your company is special. It's where you make your living and also how you build a life—for yourself but also for your loved ones, and those who work for you. It’s more than just a store or an office. Your business is a reflection of all your hopes and dreams. Doing what you can to keep it safe just makes sense! That's why one of the most sensible steps is to get outstanding small business insurance from State Farm. Small business insurance covers numerous occupations like a florist. State Farm agent Chris Caraisco is ready to help review coverages that fit your business needs. Whether you are a piano tuner, an electrician or a pet groomer, or your business is a bagel shop, a deli or a book store. Whatever your do, your State Farm agent can help because our agents are business owners too! Chris Caraisco understands the unique needs you have and is ready to review coverages that meet your needs. With State Farm, you’ll be ready to grow your business into a bright future.

Call Chris Caraisco today, and let's get down to business.

Simple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

Chris Caraisco

State Farm® Insurance AgentSimple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.